According to the stock markets, US stocks have recovered from their lows. For instance, the S&P 500 index has increased by more than 300 points from its October lows and continues to do so.

The rally’s main portion got last Friday underway. According to a Wall Street Journal story by Nick Timiraos, the Fed would consider whether it is appropriate to slow the rate hikes from 75 basis points to 50.

While still tightening financial conditions, the Fed signals a slowdown, and thus, stocks rallied.

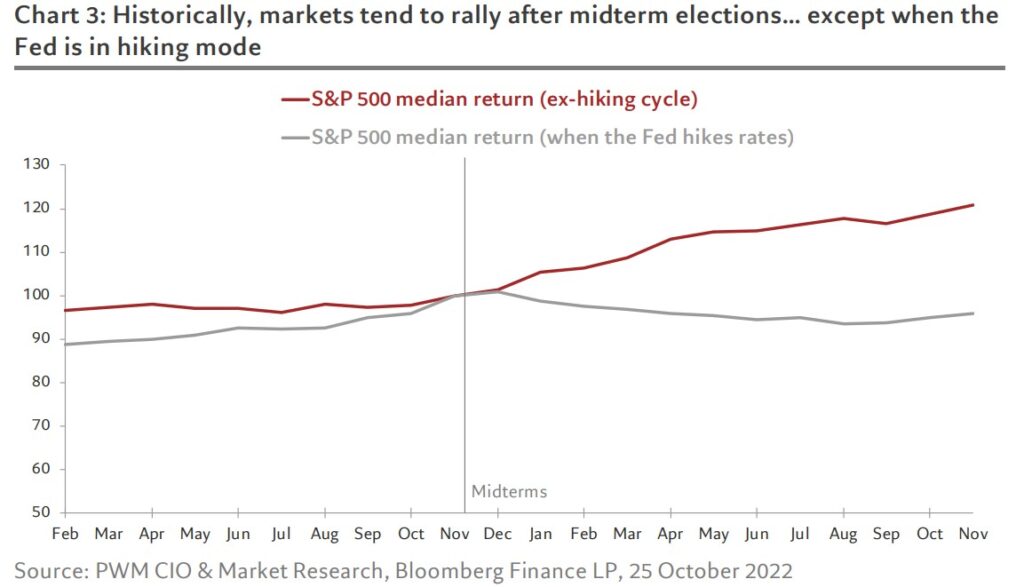

The volatility of US equities has historically been impacted by events other than the Fed’s determination of the fund’s rate. The first half of November is when the midterm elections are scheduled; historically, equities have risen following them.

However, the midterm elections are a topic of discussion for both bulls and bears.

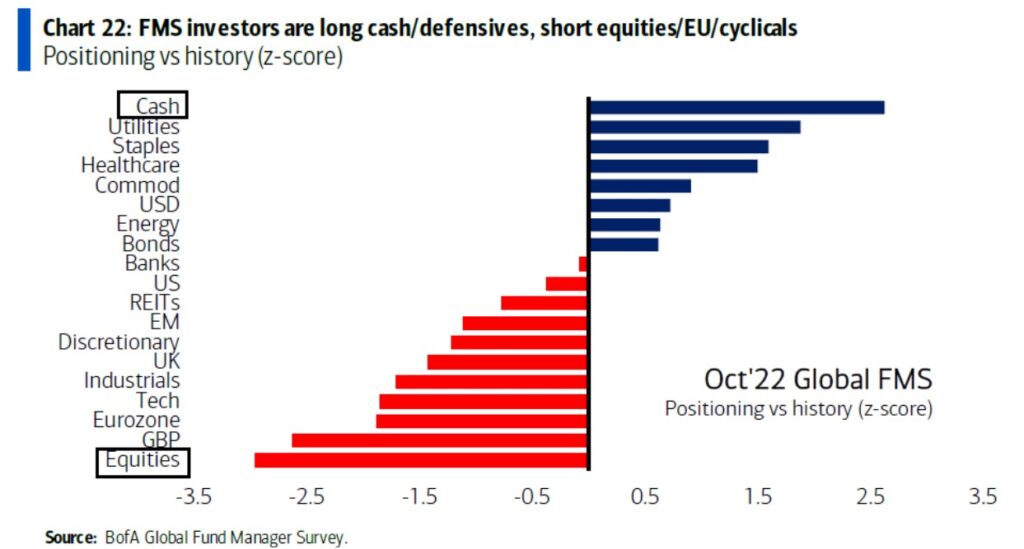

Most investors are short on US stocks

A recent Bank of America survey shows that most investors are short US stocks. Although it may appear negative, aggressive positioning has frequently caused significant short squeezes in the market.

Moreover, there is plenty of cash available to buy, as shown in the graph below.

With the Fed in hiking mode, markets may have difficulties rallying

Stocks have generally increased after midterm elections, as was previously indicated. However, when the Fed was rising interest rates, that was not the case.

This is possibly why the Fed’s announcement from last Friday that it is getting ready to talk about the halt in rate hikes is significant. In the coming months, there may be a significant rally if the market believes that the Fed is approaching the end of this cycle of rate increases and given the high positioning.

Read More:

By:

By: