Key Takeaways

- A stock screener is a tool that allows you to search for companies that meet specific criteria.

- Stock screeners can be used to find a variety of different stocks, including penny, hot, and small-cap stocks.

- The type of screener you use will depend on your trading strategy and the type of stocks you are looking for.

- News and data screeners are some of the most popular types of stock screeners.

- Setting criteria, using different scan types, exercising patience and doing thorough research is vital for using screeners effectively when trading.

If you’re new to investing, penny stocks may seem like a risky bet. But with careful research and a solid investment strategy, investing in penny stocks can be a great way to make money in the stock market. Here’s everything you need to know about trading penny stocks, from researching to buying penny stocks.

For the average person, the stock market can be a scary place. All those numbers and symbols on a screen can be confusing and intimidating. But for those who are willing to learn, it can be a great way to make some money. In this article, we will discuss penny stocks and their benefits. What penny stocks one should buy and how to invest in different equities?

What are Penny Stocks?

Penny stocks typically trade for less than $5 per share. They are usually issued by small, unknown companies and are traded on OTC market or on major stock exchanges like the New York stock exchange or NASDAQ.

The Securities and Exchange Commission (SEC) defines a “penny stock” as a security issued by a small-cap or micro-cap company that has a market capitalization of less than $250 million.

While most penny stocks generally have a bad reputation, there are some good reasons to invest in these micro-cap stocks.

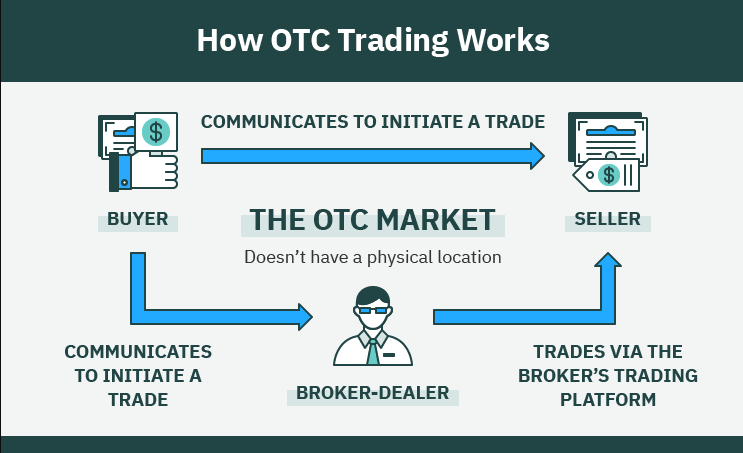

OTC Vs NYSE/NASDAQ Penny Stocks

There are two types of penny stocks: those that trade on major stock exchanges like the New York Stock Exchange or NASDAQ, and those that trade on the OTC (trade over the counter market).

Why are penny stocks risky?

OTC market group is generally considered to be riskier than their exchange-traded counterparts, as they’re not subject to the same listing requirements and regulations.

Many penny stocks in this category are not from well-established companies, you’ll see a lot of pump and dump, so evaluate your own risk.

If you’re looking for an exciting investment, penny stocks may be perfect for you. They’re also ideal for day traders or professional speculators. people who are constantly monitoring their portfolios and making quick trades to capitalize on small share price changes. If you’re someone who enjoys a little bit of risk, penny stocks could be a satisfying way to invest. The very definition of volatility, when penny stocks move, they move fast.

Why You Should Avoid OTC Penny Stocks

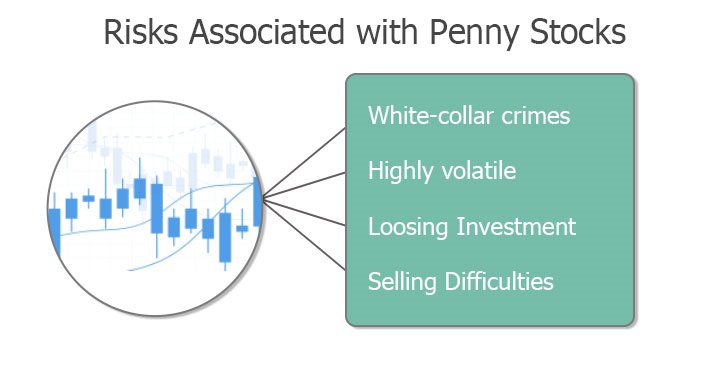

However, there are some risks associated with investing in OTC penny stocks. For one, these stocks tend to be much more volatile than their exchange-traded counterparts.

This means they can lose (or gain) value very quickly, and it can be difficult to predict when this will happen. The pump and dump scheme is also very common in OTC (over-the-counter) markets.

The 3 Tiers of penny stock companies

● Tier 1 Penny Stock Company

If you’re looking for small companies to invest in, focus on those that are listed on a major exchange. Stocks priced between $1 – $5 per share, but can occasionally be a little higher than that.

Tier 1 companies are still speculative, but less vulnerable to share price manipulation.

Since these types of companies are required by the exchanges to provide financial information, they’re considered safe compared to those in the OTC (pink sheets).

● Tier 2 Penny Stock Company

In our opinion, traditional penny stocks are those priced between 1 and 99 cents. They can’t be below 1 cent (as you may know, stocks can trade for fractions of a penny). You’ll often see stocks priced from 1 to 99 cents on major exchanges like the NYSE or NASDAQ.

When a company’s stock isn’t selling for at least $1.00 per share for 30 days in a row, the exchange sends it a formal warning (which is made public). If they comply with the listing standards, their stock will stay listed; if they fail to meet them, their stock will be de-listed and sent to the OTC market exchange.

It’s crucial to understand that penny stocks will never have a spread of less than one penny. For example, if a stock is trading at $1.02, the bid will be $1.01 and the ask will be $1.03.

Stocks that are worth less than $1 will trade for fractions of a penny.

● Tier 3 Penny Stock Company

Stocks that trade at less than a penny each are known as Sub-Penny Stocks (low-priced shares). So, start with stocks priced at 0.99. These will not be traded on the NYSE or NASDAQ, therefore I wouldn’t consider them. These aren’t particularly significant beyond the fact that the businesses aren’t strong enough to have their shares priced at 1 penny each. pump and dump schemes are very common in this type.

How to start trading Penny Stocks For Beginner

Now that we’ve looked at what penny stocks are and the different types of companies that issue them, let’s take a look at how you can start researching penny stocks and taking stock trades.

If you’re new to penny stock investing, I would recommend starting with Tier-I companies. These are usually larger businesses that are listed on known exchanges.

Many people would consider turning a small investment into a large sum of money by day trading penny stocks to be the ultimate rags-to-riches story.

Many individuals enter the penny stock market in search of fast returns, where most investors lose their shirts. At the end of the day, only 10% of active traders in the market will be profitable.

The key is learning to spot those stocks BEFORE they have a significant move.

How To Find the Best Penny Stocks To Buy

To find the top penny stocks to buy, you’ll want to look for companies that are trading on major exchanges. These companies will usually be priced under $5 per share. You can find them by doing a search on your favorite stock market website or by using a stock screener. Once you have a list of potential stocks to buy, you’ll want to do your due diligence and research each company. Look for companies with strong financials, a history of profitability, and positive analyst ratings before you buy stock. You can find this information by reading the company’s filings on the SEC’s website or by searching for analyst reports on Google.

You can also look at Rich Tv stock picks here.

When you’re into a stock investment it’s important to remember that you’re investing in a company, not just stock. Be sure to do your research and only invest in companies that you believe have a bright future. With some patience and luck, you could see your investment grow significantly!

How can you tell which ones will be the big movers?

The most important thing you can do is your homework. Research the company, its financials, products or services, and anything else that might give you an edge in knowing whether its share price is about to take off.

Another good way to find penny stocks that are primed for a breakout is to follow the news. If a company is in the news for a new product launch, a major contract, or some other positive development, that could be a good sign that its stock price is about to rise.

You can also look for technical indicators when trying to find the top stocks to buy. For example, if a stock has been trading sideways for a long time and then suddenly breaks out above resistance, that could be a sign that the stock is about to make a big move.

Remember, there are tens of thousands of companies, and no surefire way to predict which penny stock will make a big move, but if you do your homework and stay disciplined, you can give yourself a better chance of success.

Trading Strategies for Penny Stocks

The most essential thing for penny stock investors to remember is that when trading penny stocks, they must be patient and diligent.

Don’t get caught up in the hype or FOMO (fear of missing out) and avoid stock promoters. The Penny stock market is volatile, so stick to your investing plan and don’t let emotions get in the way of making good trades.

It’s also important to have a trading strategy in place before you start trading.

A trading strategy is simply a plan you follow when executing trades. There’s no single correct approach to trading, so each strategy will largely depend on the trader’s profile and preferences.

Regardless of your approach to trading, establishing a plan is crucial – it outlines clear goals and can prevent you from going off course due to emotion. Typically, you’ll want to decide what you’re trading, how you’re going to trade it, and the points at which you’ll enter and exit.

Day Trading

One popular penny stock trading strategy is day trading. Day trading is a strategy that involves entering and exiting positions within the same day. The term comes from legacy markets, referencing the fact that they’re only open for set periods during the day. Outside of those periods, day traders are not expected to keep any of their positions open.

In day trading, you’ll often rely on technical analysis to determine which assets to trade. Because profits in such a short period can be minimal, you may opt to trade across a wide range of assets to try and maximize your returns. That said, some might exclusively trade the same pair for years.

This style is obviously a very active trading strategy. It can be highly profitable, but it carries with it a significant amount of risk. As such, day trading is generally better suited to experienced traders

With this strategy, you buy cheap stock and then sell them later the same day for a profit.

To be a successful day trader, you need to have a good understanding of technical analysis and be able to identify patterns in the charts.

You also need to be able to make quick decisions and have the discipline to stick to your trading plan.

Here are a few commonly practiced strategies for day traders

● Momentum trading: This strategy involves penny stocks that are showing strong momentum (trading volume) and then selling them for a profit.

● Trend following: This strategy involves penny stock trending in a particular direction and then holding them until the trend reverses.

● Pullback trading: This strategy involves penny stocks after they have pulled back from their 52-week highs.

● Breakout trading: This strategy involves buying penny stocks that are breaking out of a particular price range.

Swing Trading

If day trading isn’t for you, then you can try swing trading penny stocks.

With this strategy, you hold onto penny stock for a few days or weeks and then sell them when they reach your target price.

This is a less risky approach than day trading, but it still requires a lot of research and knowledge to be successful.

When you’ve found a stock that meets these criteria, it’s time to do some more research to make sure it’s a good buy.

Check the company’s financials, business model, and recent news stories. If everything looks good, then you can start building your position.

We usually recommend trading stocks with at least $0.50 per share so you can make a decent profit if the stock does move higher.

Here are some swing trading strategies worth trying

● Gap and go swing trading: Using this strategy you can trade penny stocks that have gapped up in stock price and then hold them for a few days or weeks.

● Breakout swing trading: This strategy involves taking penny stocks trade that are breaking out of a particular price range and then holding them until the trend reverses.

● Support and resistance swing trading: Buy near support in uptrends or the parts of ranges or chart patterns where share prices are going up, and sell/sell short near resistance in downtrends or the parts of ranges or chart patterns where share prices are moving down, as a general rule of thumb for trading with support and resistance.

● Bull flag on the daily chart: The “pole” of the flag may be formed by a steep increase in the number of days preceding the current one. And then you want the stock price to consolidate tightly before breaking down in a countertrend or reversal trend on little volume. The last step is to purchase the break of the previous candle’s high when volume reappears.

● Stock split power: Using this strategy you can trade penny stocks that have recently split their stock and then hold them for a few days or weeks.

● Trend continuation trading strategy: This strategy involves buying penny stocks that are continuing a previous uptrend or downtrend and then holding them until a trend reversal is witnessed.

● Fibonacci retracement strategy: An integral aspect of many trend-trading strategies is the utilization of Fibonacci retracements. Traders in this case will look for retracements inside an existing trend and attempt low-risk entry back in the direction of the original trend utilizing Fibonacci levels.

● Bollinger bands squeeze breakout: The Squeeze is predicated on the assumption that stock market volatility always and repeatedly alternates between high and low points. When the volatility of equities has been low for six months, as seen by a small separation of the Bollinger Bands, big breakouts are common.

● MACD crossover swing trading: Traders get a buy signal when the MACD line crosses over the signal line. If, after the cross-over, the signal line is located above the MACD line, a sell signal will be generated.

● RSI trading strategy: Using this strategy you can invest in penny stocks that are oversold or overbought on the RSI and then hold them until the trend reverses.

● Stochastic oscillator trading strategy: The stochastic indicator provides buy and sell signals. A long-short strategy or a long-only strategy may be developed using the signals.

Scalping

This strategy involves buying and then selling immediately for a small profit. Scalpers look for certain penny stocks that are moving in a tight range and then trade them back and forth until they make a profit.

Once you have shortlisted penny stock companies build your stock watchlist. A watchlist is a list of stocks that you’re interested in and is monitored for potential trades.

To build your penny stock watchlist, start by looking at the companies that interest you and then narrow it down to the best of the best by using the criteria we’ve discussed.

Due Diligence

Due diligence is the process of investigating before you invest in penny stocks. When you’re looking at penny stocks, you need to be especially diligent, because there is a lot of fraud in the penny stock world, especially in the OTC markets and small companies.

Before you invest in penny stocks make sure you understand the company’s financial history and business model. Look for red flags like insider selling, large amounts of debt, or a history of fraud.

Frequently Asked Questions

How do you buy penny stocks?

You can buy penny stocks through a brokerage firm, there are many online brokers and you can create your brokerage account with the one that suits you.

What is the best penny stock to buy?

The best penny stock to buy depends on your investment goals, personal finance, and risk tolerance.

What are the risks of investing in penny stocks?

Some of the risks of investing in penny stocks include high stock prices volatility, easily manipulated fraudulent activity, bad track record, lack of transparency and regulation, poorly run companies, difficulty in research, pump-and-dump schemes, bad past performance, and narrow trading windows.

How can I avoid losing money in penny stocks?

You can avoid losing money when you invest in penny stocks by doing your research to find good investment opportunities, investing slowly, and monitoring your positions. Never put your entire investment in one stock and With a little bit of effort, you can be a successful penny stock trader!

What is the best way to research penny stocks?

You can research penny stocks by looking at the company’s financial history, business model, and red flags like insider selling. You can also use proprietary scanners to find stocks that are moving on high volume. you can also take investment advice from financial advisors. Finally, make sure to always monitor your positions to ensure you’re making money.

Conclusion

Penny stocks are a great way for new investors to get started in the stock market. By following the steps we’ve outlined above, you can increase your chances of investing in penny stocks that will make you money. Do your due diligence, build your position slowly, and always monitor your positions to make sure you’re making money. With a little bit of research and effort, you can be a successful penny stock trader!

By:

By: