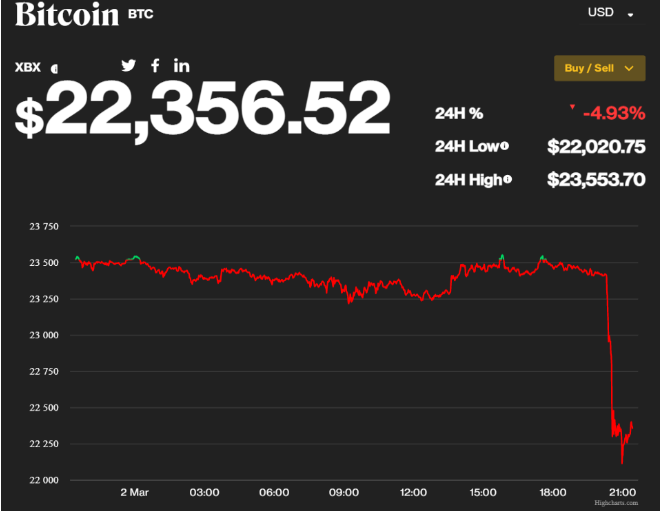

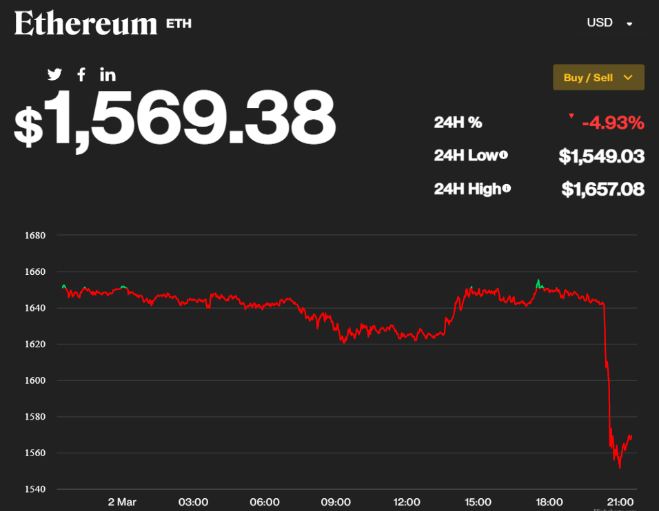

In the early hours of the trading day in East Asia, Bitcoin fell to $22,277 while Ether reached $1,563.

Major digital assets plunged as the business day began in Hong Kong on Friday.

As investors fled crypto bank Silvergate, whose stock fell 58% during U.S. trade on Thursday, both bitcoin (BTC) and ether (ETH) both fell more than 5%. Most of the other top 10 cryptocurrencies by market cap experienced decreases comparable to those of BTC and ETH.

Another source of volatility identified by Ruck is the potential release of some of Mt. Gox’s bitcoin, which would raise its available supply.

Major cryptocurrency exchange Coinbase suffered damage from the quick sell-off and had connectivity problems at 10:20 a.m. Hong Kong time. Similar problems were not reported by other significant cryptocurrency exchanges like Binance, Bitfinex, Kucoin, OKX, and Kraken.

At the start of the Asian trading day, the price of bitcoin dropped to an intraday low of $22,020 after largely holding stable about $23,500 throughout the day. After falling to just about $22,400, it seemed to have slightly recovered.

Similar trends were observed with ether, which dropped from $1,650 to $1,550 after spending the previous day largely unchanged.

According to CoinMarketCap, the market capitalization of bitcoin dropped by nearly $20 billion to $431.9 billion. The total market value of cryptocurrency is $1.07 trillion. According to Coinglass, open interest in bitcoin futures has decreased by 8.8% during the past four hours. Ether’s open interest decreased by 5%.

Reading More:

By:

By: