Ferrari (RACE:NYSE)

As one of the world’s most renowned luxury carmakers, Ferrari stands far ahead of its competition in terms of transitioning to full-electric and hybrid vehicles. While other companies must battle industry-wide pressures to make the switch, Ferrari is on track to reach its goal of having 80% electric and hybrid models by 2023. This clear long-term strategy has certainly been noticed by investors and analysts alike. Just this past April Ferrari revealed plans for its first all-electric model, set to debut in 2025, as well as another 15 models through 2026.

Recent stock rankings have Ferrari (RACE) at a beneficial position comparatively, with analyst ratings giving it a “buy” rating while recommending that investors remain above the $240.00-$242.00 range with an upside target of $365.00-$375.00 – much higher than the March 3rd 52 week low closing price of $152.15/share per Yahoo Finance data. It looks like investing in Ferrari is still a great idea!

Beacon Roofing Supply (BECN:NASDAQ)

Beacon’s record-breaking 2021 was capped off by their strongest fourth quarter and full-year sales yet. This is, in large part, due to a housing market that continues to require maintenance even if the economy slows down. The company further bolstered their success with the acquisition of Coastal in the 4th quarter, expanding their waterproofing and restoration segments. To expand even further, Beacon invested heavily in Greenfield locations, adding 16 new locations throughout last year.

Beacon looks like a bright investment opportunity going into next year, as long as stock prices remain above $58.00-$60.00 according to analysts we are bullish on the company and project an upside target of $82.00-$84.00.

ETH/USDT

ETH saw a market-wide decline on Friday, dropping from $1,650 (a level of resistance) all the way to support around $1,550. Since then, ETH has been trading sideways, and given the current state of the market, it may stay in this consolidation zone for a little bit longer.

For ETH, the next area of resistance is between $1,650 and $1,700. If ETH loses the $1,500–1,550 range, the next support range is between $1,350–1,400.

LINK/USDT

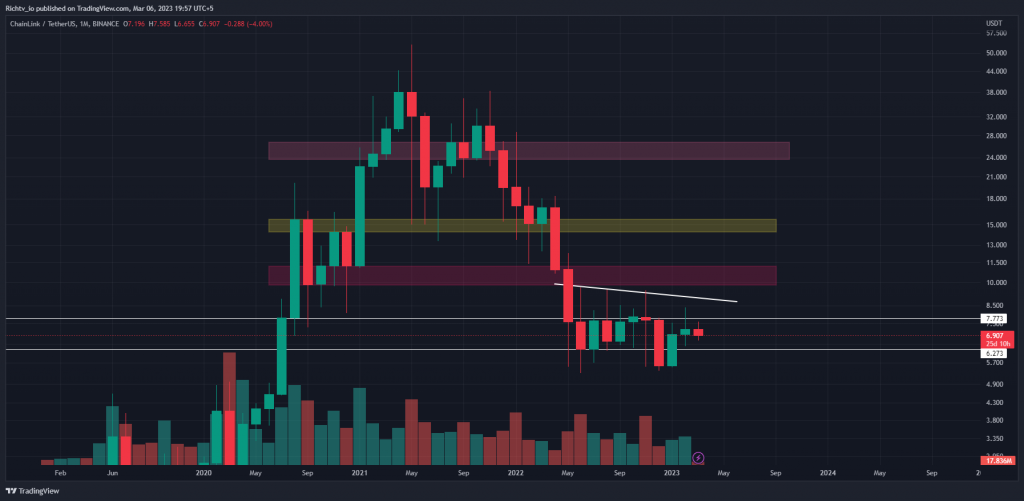

LINK has been trading in the $6.27 to $7.77 range for months, and it is still doing so. This range-bound construction has been one of the most dependably solid plays in the sector.

In particular, LINK rallies as is characteristic of intra-range consolidation from the Range Low to the Range High and back to the Range Low.

There is a potential that history will repeat itself and LINK descends below the Range Low for yet another retest given the recent rejection at the Range High resistance.

By:

By: