Key Takeaways

- There are a variety of stock order types available for trading stocks that may be employed to your advantage depending on your investment strategy.

- When shares are purchased (or sold) at the current market price until the order is completed, the stock order type is referred to as a “market order.”

- A limit order requires the order to be completed at or below a specified price, but there is no assurance that the order will trade if the limit is too high or too low.

- Stop orders are a special kind of market order that are executed when a stock price reaches a specified price or falls below a specified price. Stop orders are often used to protect against further losses or to secure profits.

As the internet and digital technologies continue to advance, more and more investors are choosing to trade stocks on their own rather to pay advisors high commission fees. But before you go out and start trading stocks, you need to learn the various orders and when to use them.

In this piece, we’ll go over the fundamental stock order types and how they might help you achieve your investment goals.

Major Stock Order Types

Every investor has to be familiar with the two stock order types, the market order and the limit order.

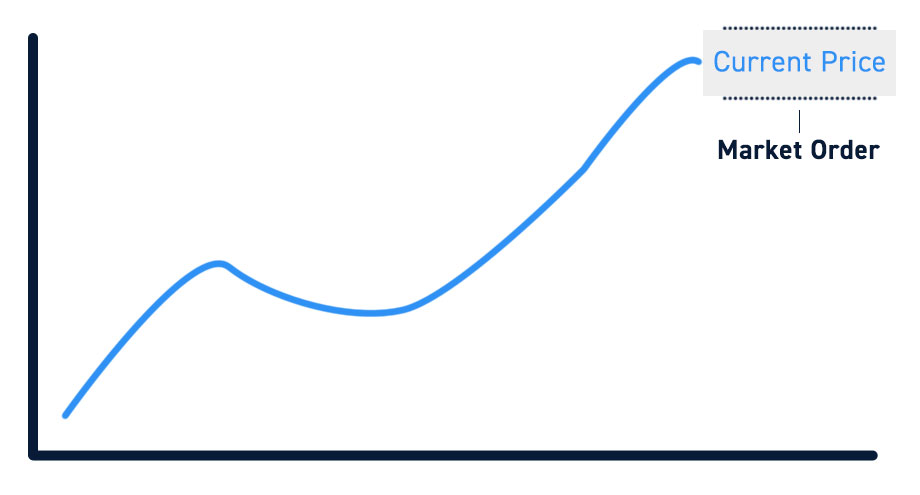

Market Orders

The most fundamental kind of trade is known as a market order. A market order is a request to purchase or sell at the current market price immediately. As a general rule, if you want to acquire a stock, you should offer to pay the same or close to what it is being asked for. A stock’s selling price will be at or near the current bid if you plan to sell it.

One thing to keep in mind is that the market order may not be executed at the latest traded price. The price at which a deal is actually executed may differ from the last traded price in a turbulent market with frequent price fluctuations. Only when the current bid/ask spread is the same as the last traded price will the price stay unchanged.

Those who wish to purchase or sell a stock immediately like using market orders. Utilizing market orders ensures that your deal will be performed as quickly as possible and at the best available price. Market orders for companies that trade over tens of thousands of shares per day are likely to be executed around the bid/ask prices, so the investor should expect a price close to the current market price.

Limit Orders

Limit orders, also known as pending orders, provide traders the opportunity to purchase and sell securities at a predetermined price in the future. You may use this order type to make a purchase or sale only if the market price hits a certain threshold that you specify. To put it simply, a limit order specifies the highest or lowest possible purchase or sale price.

If you wanted to acquire a stock but only wanted to pay $10 per share, you could place a limit order for that amount. That stock wouldn’t see a price increase of more than $1 if you paid exactly $10 for it. Even if you set the purchase price at $10 per share, there is a chance you might end up paying less.

Limit orders may be broken down into four types:

- “Buy Limit” refers to a limit order placed to buy a security at or below a certain price. It is important to put limit orders on the right side of the market in order to achieve their intended effect of raising the price. In the case of a purchase limit order, this implies setting the price of the order below the current bid.

- “Sell Limit” is an order to sell a security at or above a certain price. If you want a better deal, you need to set your order higher than the current market asks.

- “Buy Stop” is a limit order to purchase a security at a price more than the highest existing bid. When a certain price point is reached, a stop order to purchase goes into effect (known as the stop level). In the world of trading, a “buy stop” order is put above the market, while a “sell stop” order is placed below it. Once a stop price is achieved, the order automatically changes to a market or limit order.

- “Sell Stop” is a market order to sell a security at a price below the current Ask price. A sell stop, like a buy stop, doesn’t take effect until the market price reaches a certain threshold.

Investors should consider the additional fees associated with each order type before selecting between a market order and a limit order. Market orders often have lower commission fees than limit orders. A commission difference of more than $10 is not uncommon. Putting a limit on a market order, for instance, would increase the cost from $10 to $15. Be sure your limit order will be profitable before placing it.

Assume that your broker bills you $7 for a market order and $12 for a limit order. You’d like to acquire shares of XYZ Corporation stock, which are now selling for $50 each, for $49.90 each. An order to purchase 10 shares at the market price of $50 each would cost $500 plus $7 in fee, for a total of $507. It would cost $499 plus $12 in costs to place a limit order for 10 shares at $49.90, bringing the total to $511.

While you would save $1 by purchasing the stock at a discount (10 shares x $0.10 = $1), you would end up spending an additional $5 on the order’s fees. Furthermore, there is no guarantee that the stock price will drop to $49.90 or below once the limit order is placed. Therefore, if it keeps going up, you risk missing out on a good buying opportunity.

Other Stock Order Types

Now that we’ve covered the two fundamental stock order types, we’ll go through the many limits and specific instructions that might be placed on them by various brokerages.

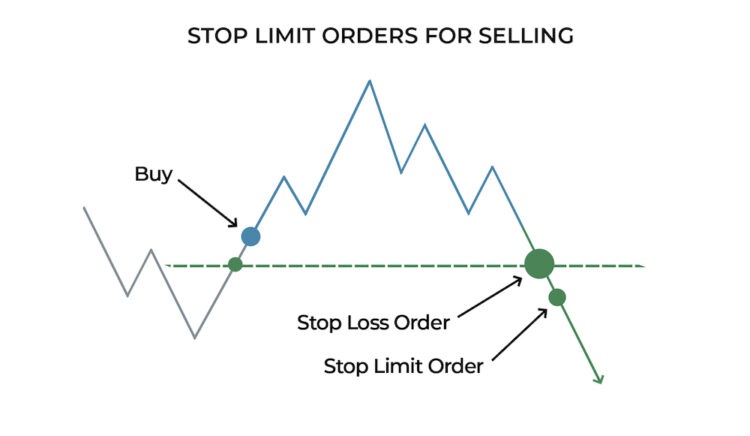

Stop-Loss Order

A stop-loss order is also known as as an on-stop buy or sell. Contrary to limit and market orders, which become active as soon as they are entered, this order is inactive until a certain price is reached, at which point it becomes a market order.

In case a stop-loss sell order were put on XYZ shares at $45 per share, the order would remain inactive until the price of the shares either hit or fell below $45. In such a case, the order would be converted into a market order, and the shares would be sold at the best available price. In the event that you don’t have the resources to constantly monitor the market but still want protection against a significant decline, this form of order may be for you. Before going on vacation is an ideal opportunity to place a stop order.

Stop-Limit Order

This kind of order is quite similar to a stop-loss order, except it will only be executed at a certain price. A stop-limit order specifies two prices: the stop price, at which the order automatically becomes a sell order, and the limit price, above or below which the order cannot be executed. Changes the sell order from a market order to a limit order, which will only be fulfilled at or above the specified price. The risk of stop-loss orders being executed during a flash crash, when prices drop sharply before recovering, is reduced by this.

All or none (AON)

This form of order is very helpful for people who purchase penny stocks. If you place an “all-or-none” order, you will get exactly the amount you specified or nothing at all.

This creates issues when the stock is very illiquid or when a limit is set on the order. An all-or-none limitation would prevent the filling of an order to purchase 2,000 shares of XYZ if only 1,000 were being sold at the time. If you submit an order for 2,000 shares but don’t specify an all-or-none limit, only 1,000 of those shares will be purchased.

Immediate or Cancel (IOC)

For orders with IOC instructions, only the portion of the order that can be executed in the market (or at a limit) within a very short time period, often only a few seconds or less, must be filled, and the remainder of the order must be canceled. If no transaction occurs in the “immediate” time frame, the order is canceled.

Fill or Kill (FOK)

This order combines an AON order with an IOC specification, meaning that the full order size must be traded in a very short time period, often a few seconds or less. The order will be canceled if none of these conditions is satisfied.

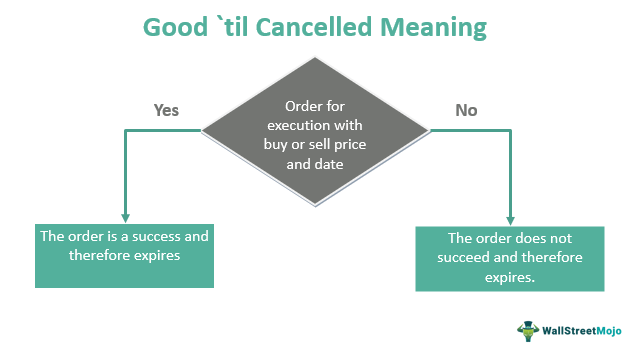

Good ‘Til Canceled (GTC)

In this case, “time limit” refers to the ability to impose a deadline on certain requests. If you place an order that is “Good ‘Til Canceled” it won’t expire unless you explicitly cancel it.

A normal brokerage’s maximum order open (or active) period is 90 days.

Day

If the GTC command is not used to indicate an end date, the order will be treated as a day order and will expire at the end of that trading day. What this implies is that the order will be nullified at the close of business on the day it was placed. If it doesn’t get traded (filled), you’ll have to input it again the next trading day.

Take Profit

A take profit order (also known as a profit target) is a kind of stop loss order that is used to exit a trade in the black after it has achieved a predetermined profit threshold. A position is closed when a take profit order is executed. An open position of a pending order is always associated with this order type.

Stock Order Types FAQs

What time limitations and additional instructions can I put on an order?

When placing a stock trading order, you may specify a time restriction by choosing from the following time-in-force options: “Day,” “Good ’til canceled,” “Fill or kill,” “Immediate or cancel,” “All or None,” etc.

What is the formula for calculating commissions on orders that are valid until canceled?

When your order is performed, the commission for an order that is valid until canceled is calculated.

Multiple executions of the same order on the same day will result in just a single commission being charged. Commissions are charged on a per-day basis for good ’til canceled orders that are executed on several days.

Commissions are not applied to Good ’til Canceled orders that do not execute.

How do dividend payouts influence current orders?

Good ’til canceled (GTC) orders placed below the market are often adjusted for the dividend amount, however this may vary from exchange to exchange. Except if you specify a do not reduce (DNR) when placing your purchase, the price of your order will be lowered on the “ex-dividend” date by an amount roughly equal to the future dividend. Among the orders placed below the market are the purchase limit, the sell stop loss, the sell stop limit, the sell trailing stop loss, and the sell trailing stop limit.

Conclusion

It is crucial for an individual investor to understand the difference between a limit order and a market order. There are scenarios in which one order type would be preferable to the other, and your investing strategy would also play a role in determining the stock order type you would choose.

Cost is a factor, but for a long-term investor, whose investment choice is based on fundamentals that will play out over months and years, the present market price is less of a concern, therefore they are more likely to go with a market order. When a trader enters a position, he or she is often aiming to capitalise on a shorter-term trend in the charts and is, as a result, much more price-conscious about the market price paid.

When you understand the various stock order types and how they could effect your trading, you can choose the one that best meets your goals as an investor, reduces your exposure to risk, and minimises your costs.

By:

By: