Boeing (BA:NYSE)

Last week’s news of the major U.S. Air Force contract was a big boost for Boeing, and inspired optimism from analysts who view it as an indication of future orders from the government.

The positive news combined with the stock remaining above $164.00-$166.00 gives me reason to remain bullish on Boeing, and I’m expecting upside potential in the range of $275.00-$280.00 for those that are looking to invest in this company in the near-term.

It is always wise to be cautious; however, with stocks like Boeing offering promising news and healthy movement in value even during these tough times, now may be an excellent opportunity for calculative investors to consider adding it to their portfolios.

Olympic Steel (ZEUS:NASDAQ)

As far as investments go, I am feeling optimistic about ZEUS ever since the stock has been hovering between $29.00-$30.00. If it continues to hold steady and not dip below, I anticipate that my upside target of $53.00-$55.00 in the near future.

With bullish sentiment and satisfactory technical analysis, there is high potential to realize returns through buying into this company’s success and progress.

Even though some risk factors involve the company’s fiscal performance and potential downturns in the market.

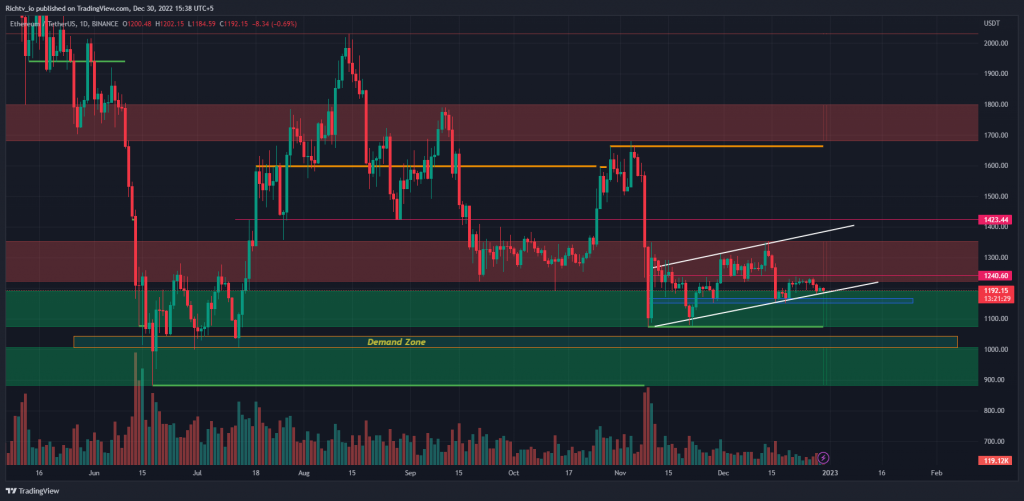

ETH/USDT

We’re back to analyzing Ethereum (ETH), the top DeFi cryptocurrency. We see that Ethereum remains largely range-bound within an ascending price channel. This is a concern for bulls because these are known to be continuation patterns, which means they often resolve in the direction of the underlying trend.

If prices start closing below the lower trendline of the channel, then we could easily see a retest of support at $800-$1,000. Technical resistance remains in the $1,300-$1,320 zone, which would need to be cleared to generate any sort of bullish momentum.

I remain focused on Ethereum avoiding a break below the June lows. If ETH manages to achieve this feat, it would be a strong technical signal that the market expects decentralized tokens to outperform and be the future of crypto. Bitcoin (BTC) has already taken out its low from June, and thus is exhibiting relative weakness.

BNB/USDT

Binance Coin lost 5.73% in the last couple of days. Despite this, buyers did manage to stop BNB from falling to new lows. With good support at $220, the price could end up moving sideways until volatility returns to decide the next steps.

The resistance at $262 was not yet tested. This could be interpreted as a weakness in the price action that already reversed at $254 from its bounce on the key support. It is crucial for buyers to sustain the momentum and push BNB above $262. Otherwise, the key support may be put under pressure again.

Looking ahead, as long buyers as manage to defend the key support at $220 and $200, then Binance Coin has a good chance to avoid lower lows this year which would be a significant achievement, similar to ETH.

By:

By: