ETH/USDT

In the past week, Ethereum (ETH) has failed to move above the key resistance at $1,365. Since then, bears took over, which resulted in a loss of around 16.36%. With this latest rejection, the bias has turned negative.

The next levels of support are $1,080 and $1,000. In the past, buyers always came back in force at these prices. What is concerning is that the current market structure is bearish with lower highs, and this could eventually lead to a lower low.

Looking ahead, ETH has the difficult task of stopping the current downtrend. While in the past, buyers managed to defend well the current support levels, sellers may no longer be satisfied at $1,000. This is why, in the future, they could attempt to push the price into the three digits territory.

XRP/USDT

XRP also had a difficult week where the price fell by 14.71%. This took its price back on the key support at $0.3360. Ideally, the correction ends here, but buyers appear weak, and the overall market is turning red.

With the decreasing volume and a falling price, the outlook for Ripple is bearish. If this correction does not end soon, then sellers could push the price all the way down to the next level of support found at $0.3053.

The major hope at this point is for XRP to make a higher low and attempt a recovery into the New Year.

IMX/USDT

The current state of the market has seen $0.771 become a critical level that needs to be held if there is any hope for turning bullish again in the short to medium term. Without this key level, it is likely that the downtrend will continue. Therefore, traders must pay close attention and identify potential opportunities to buy on dips when the market is near this level.

Although there is potential for profit, traders must also be aware of the risk of getting stopped out if the market fails to hold that key level. It is therefore essential to have a well-constructed trading plan and risk management strategy in place before attempting to trade in these conditions.

But not just clear! It needs to hold above that level.

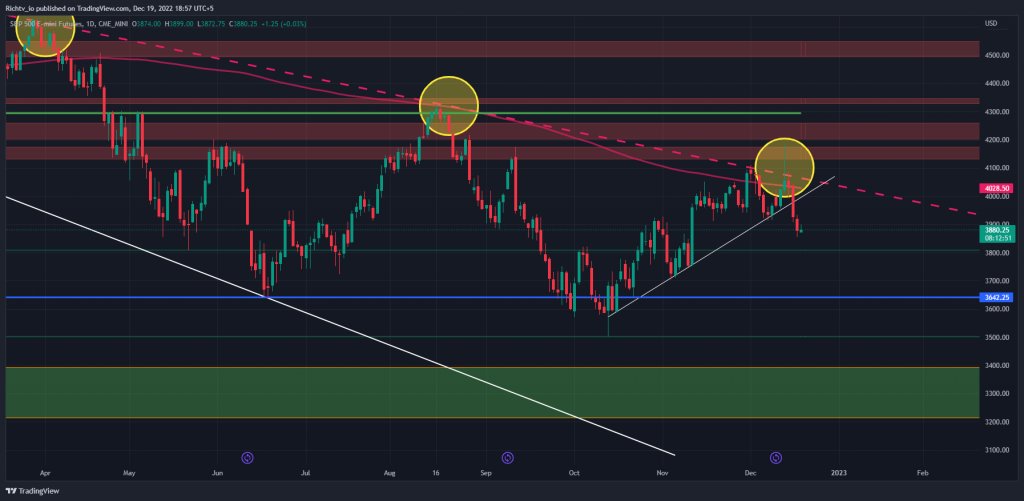

S&P 500 E-mini Futures

One of the biggest options expirations happens today, worth $4 trillion – a big market-moving event.

With a clean rejection off of the diagonal trend line, which has been governing the downtrend, we now expect lower prices.

I’m looking at 3,642 for potential support – the horizontal at the lows. If that level is lost, I suspect the next support to be at pre-COVID lows.

By:

By: