Park City Group (PCYG: NASDAQ)

The Covid lockdowns created havoc in the supply chains of many industries, especially when it comes to food. One silver lining, however, has been the emergence of new opportunities for companies to step up and fulfill gaps in the market. PCYG, in particular, is in an exceptional position to meet this need. With almost 100% of its revenue being recurring in some form, it has a robust business model that is sustainable in the long run. Additionally, with over 28,000 customers, PCYG has an established presence in the market that positions it for growth.

The potential for revenue can make or break a company. And for those utilizing ReposiTrak Traceability Network, the possibilities are looking up. This innovative service offers companies the opportunity for a significant boost in profits, ranging from $1 to $2 million in annual recurring revenue per customer within just a couple of years. We’ve set our upside target at $14-15 and are eagerly anticipating the potential for success.

DraftKings (DKNG: NASDAQ)

DraftKings, a popular online sports betting platform, has been making some moves recently that have been catching the eye of investors and enthusiasts alike. One of their most notable tactics has been their expansion into both the Massachusetts and Ohio markets, which has helped to increase their already impressive customer base by significant numbers. However, what’s really turning heads is the fact that they’ve been able to achieve this expansion while simultaneously lowering their customer acquisition costs by 27%. This indicates some savvy business practices at play and bodes well for the future of the company. Additionally, they recently turned down an acquisition deal with PointsBets, which shows that they are exercising discretion in their growth and are aiming to expand in a manner that is sustainable for the long haul.

DraftKings already represents over 25% of it in the United States. And with its investments in states like New Jersey and Illinois, management expects to recoup costs in less than three years. But for those considering investing in the company, it may be wise to wait until it remains above the $22.50-$23.00 mark. With a potential upside target of $34.00-$35.00, the future looks promising for DraftKings.

FTM/USDT

The past week has been a challenging one for Fantom (FTM) as it has experienced a significant price retracement due to fear, uncertainty, and doubt (FUD).

The market saw a drop from $0.32 to $0.26, leaving FTM in an oversold state. Currently sitting in the $0.255 – $0.26 support zone, the market is anticipating a reaction that could bring about a rebound and test the next resistance area situated at $0.28 – $0.29.

However, if the current support fails, FTM’s next support can be found in the range low area of $0.198 – $0.21. Regardless of the ups and downs, it’s important to hold tight and stay informed during these fast-paced and unpredictable times in the crypto market.

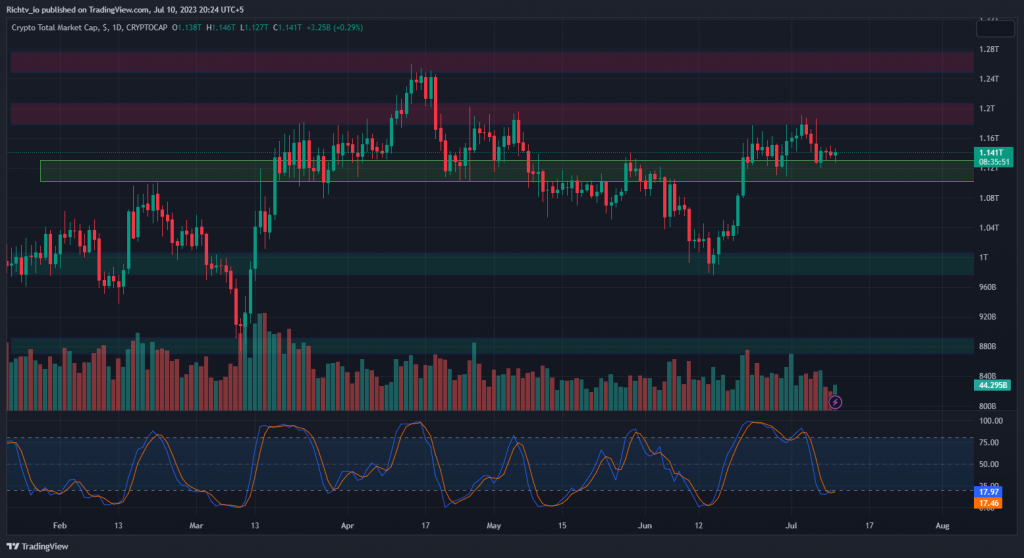

TOTAL 1

The TOTAL recently faced rejection in the range of $1.18T – $1.2T and has now fallen back to the next support area at $1.10T – $1.13T.

The market is oversold as per higher time frame indicators, but it may remain like that for some time while consolidating at the current support in the upcoming days.

If the present support fails, the next one is at $1.05T, followed by a considerable support zone at $975B – $1T. Despite this, there is still potential for an increase in the market in the next few weeks. If the resistance at $1.18T – $1.2T is broken, it could pave the way for the next significant resistance at $1.26T – $1.3T.

By:

By: