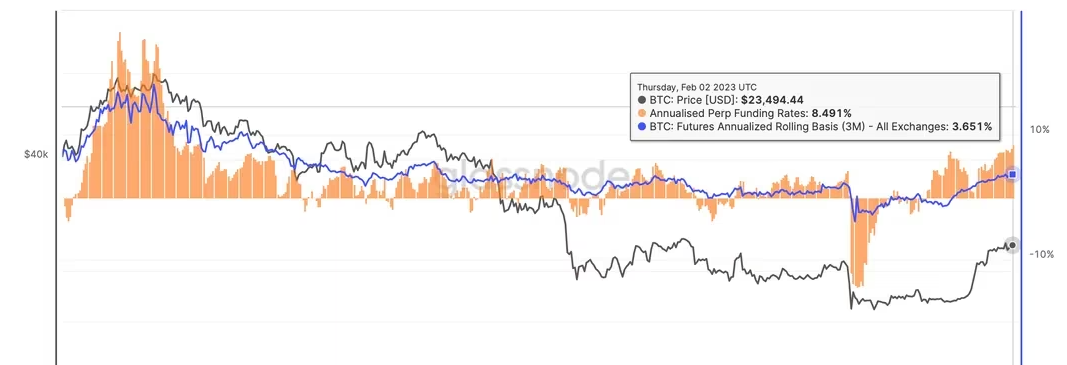

The price of maintaining a bullish long position in bitcoin perpetual futures has risen to its greatest level since the ecstatic bull market days of late 2021.

Funding rates, a mechanism that keeps the pricing of bitcoin perpetual futures contracts in line with the spot market price, are sending that message. The financing rate is positive and holders of bullish long, or buy, positions pay bearish shorts to keep their trade open while perpetual futures are trading above spot. Perpetuals that trade below the current price have the opposite effect.

To assess the attitude of leverage traders, analysts monitor the financing rate. Traders are more enthusiastic about price possibilities and more willing to pay a premium to maintain their upside bets when the funding rate is higher.

According to data recorded by blockchain analytics company Glassnode as of Thursday, the yearly bitcoin permanent financing rates across key exchanges, including Binance, were 8.491%, the highest since December 3, 2021.

Back then, one bitcoin was priced around $57,000 or 2.5 times the current market rate of $23,400. The cryptocurrency set a record high of $69,000 in November 2021.

In mid-December of last year, the financing rate changed from negative to positive, signalling seller weariness. At the beginning of the year, the cryptocurrency saw a significant increase in demand, and it has since increased by over 40%.

Dessislava Laneva, a research analyst at Paris-based crypto data company Kaiko, tweeted on the market’s mood after the U.S. consumer price index: “There has been a definite shift in market sentiment post-[December] CPI with financing rates well into positive territory and price volatility on the upswing.”

The CPI decreased to 6.5% in December, the sixth consecutive month in which price rises have slowed. Markets were persuaded by the data that the Federal Reserve (Fed) was likely to switch to interest rate reductions that would increase liquidity later this year.

Early this week, the Fed chair Jerome Powell acknowledged the inflation picture and downplayed concerns of a severe tightening-induced economic slowdown, bolstering the pivot hopes.

Focus on U.S. nonfarm payrolls

According to Reuters estimates obtained from FXStreet, the U.S. nonfarm payrolls (NFP) data due out at 13:30 UTC is projected to indicate that the largest economy in the world added 185,000 jobs in January after adding 223,000 in December.

The unemployment rate is anticipated to increase slightly to 3.6% in January, while average hourly earnings, or wage growth, is anticipated to register at 4.9% year-over-year after increasing by 4.6% in December.

Investors may rethink the possibility of the Fed keeping interest rates higher for longer if there is a significant increase in average hourly earnings, a proxy for potential inflation, combined with the headline jobs figure. They may also scale back bullish positions in risk assets, including cryptocurrencies.

Reading More:

By:

By: